Profit Reporting Season

- 0 Comments

- February 17, 2017

- by Curtis Taylor

- Leave a comment

Three Trends Set To Define February’s Reporting Season

Hey, it’s February and summer holidays already seem like a distant memory. So it’s time to get back to capitalism. The American market so far this year is coming up trumps up 3%. Although maybe Donald isn’t the pinup boy for Australian investors with the All Ordinaries pretty well-unchanged calendar year to date. Maybe Australian investors are still having summer holidays.

Of course, we know it’s not what markets do over time but how the actual stocks in which you are invested perform as a business over time. If a majority of your shares are able to grow profits and dividends over time you can expect a growing income stream and capital growth over time regardless of any market gyrations or individual price volatility on the way through. Which means we want shares that are high quality, have favourable prospects and can be bought at a price that represents good value.

February and August when most companies report their profits (or lack of them) is when individual stocks are reviewed to see whether or not they still do or don’t meet the tests of quality, prospects and value. So what are some of the themes for this profit reporting season?

The following is an article by Damen Kloeckner Associate Analyst for Clime Asset Management which has a look at some of the more important themes for this year. It is included in this newsletter with their permission. For more information on or a free trial of StocksInValue go to www.stocksinvalue.com.au.

It should be noted that this blog contains no recommendations it is just providing information and comment. You should seek advice if you are considering buying or selling any investments. If you would like to discuss with me anything in this blog you are welcome to do so. Contact details are at www.lifestylefstas.com.au.

Regards

Curtis

Three trends set to define February’s reporting season

Reporting season can be a tumultuous time for investors, full of all the drama, intrigue and revelation of a good spy movie. This year, perhaps more than others in recent memory, we believe there is a heightened level of risk in three key areas of the broader market. Overlay this with the human roulette wheel that is Donald Trump, and you have the makings of a very interesting month ahead.

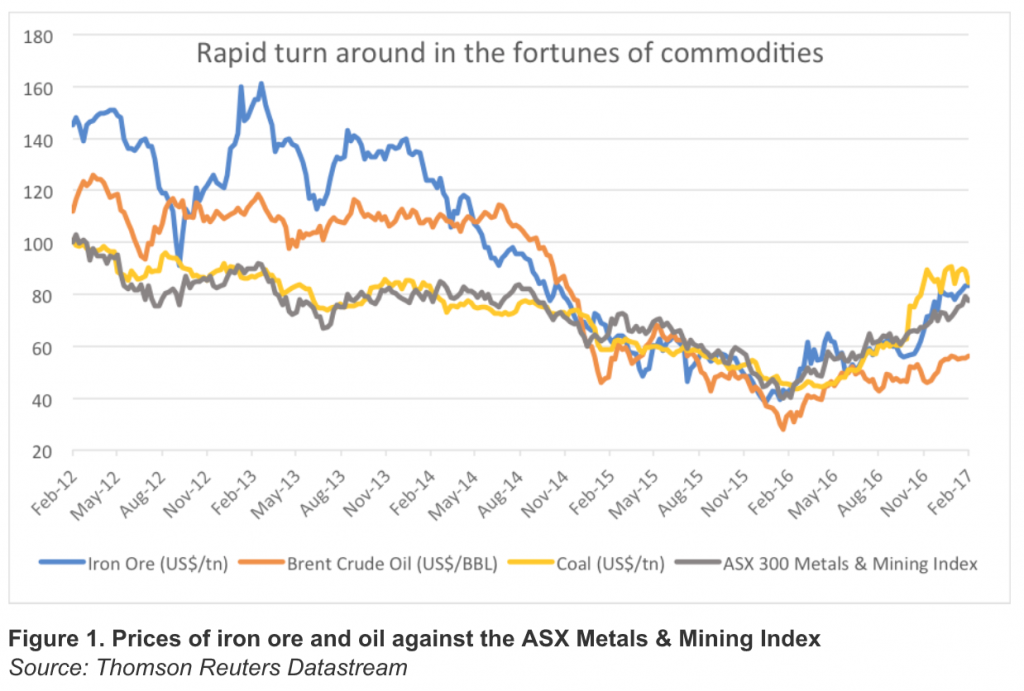

A lot of optimism riding on resources

Resources stocks have surged over the past few months in line with the prices of iron ore, crude oil and other benchmark commodities. The prospect of massive infrastructure spending in the US and the stabilisation of Chinese economic growth, in addition to improving PMI[1] data has also supported the ‘return of resources’ theme. As investors’ scepticism has turned to optimism, many stocks’ share prices have skyrocketed, and now contain (beyond elevated prices just being maintained) an expectation of further price rises in the future. Given the volatility of manufacturing demand from China, and the lack of details surrounding Trump’s infrastructure spending plan and outright speculation in setting key commodity prices, this level of optimism carries a good deal of risk.

Trepidation over Christmas retail sales

This same optimism has failed to translate to the domestic retail sector, where trepidation over the outcome of the most recent Christmas trading period is rife. In particular, there are concerns that aggressive early discounting in November led to softer volumes over the holidays. Casualties of confession season already include well-known retailers such as Oroton, Billabong and Shaver Shop and the coming month will likely uncover more challenges within the sector. Lingering anxiety over the encroachment of online retail giant Amazon into the Australian market has only compounded the pressure on the sector, and is unlikely to be abated in the near term. Of course, in broad sell-offs of this nature, there are opportunities to pick up those stocks that have been unfairly ‘tarred with the same brush’. We believe retailers resistant to online disruption and discounting, typically control well-known brands or market products, which require interaction and physical touch such as shoes, jewellery or furniture. We will be paying close attention to the ABS retail trade data for December, due to be released on 6 February.

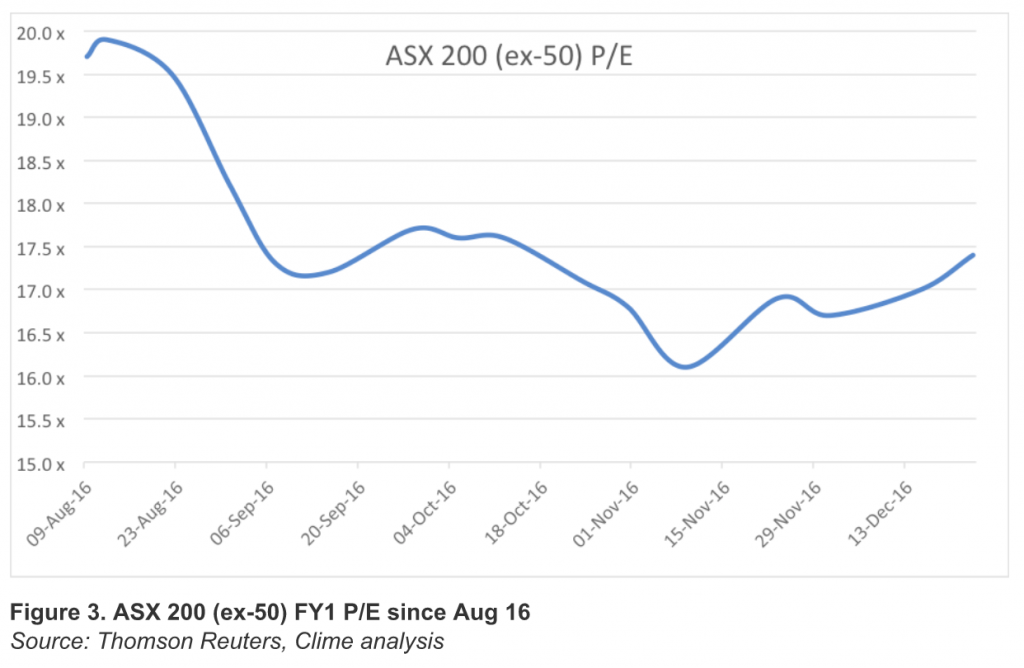

Growth stocks in the mid-market continue to be a minefield

Retailers haven’t been the only casualties of pre-reporting season misgivings. Midcap growth stocks, the recent darlings of the market, have become a minefield, with expectations and share prices tumbling back to earth. Such results are a stunning reminder of the binary outcomes of ultra-high P/E stocks, whose onerous expectations and extrapolation of success can lead to spectacular price reactions if they disappoint or downgrade. Since their recent peaks, Bellamy’s (down 71%), Aconex (down 66%), Sirtex (down 59%) and Blackmores (down 44%) have destroyed a vast amount of investor capital. Whether this is a symptom or a cause of the broader de-rate of mid-cap stocks since August is hard to say as we’ve also observed a broader rotation out of mid and small companies into the large-caps. What has become clear is that investors are scrutinising growth in this space with a newfound intensity.

Successful navigation of the upcoming February reporting season is something all investors seek to achieve. We believe this February will be as much about avoiding the landmines of disappointing growth stocks as it is about identifying undervalued stocks with genuine, sustainable growth. We expect upcoming volatility to provide the opportunity to selectively deploy capital into our most favoured positions. Be aware of inherent risk within resources and retailers and have conviction in backing your best investment ideas.

[1] Purchasing manager index, a leading indicator of resources demand

OWNERSHIP DISCLOSURES:

N/A

DISCLAIMER

Disclaimer: StocksInValue and associated websites are published by Stocks In Value Pty Ltd ACN 162 644 724 (SIV), Authorised Representative of Clime Asset Management Pty Limited ACN 098 420 770 AFS Licence 221146. The information provided in this document is intended for general use only. The information presented does not take into account the investment objectives, financial situation and advisory needs of any particular person nor does the information provided constitute investment advice. Because of this, you should, before acting on any information on this website, consider whether it is appropriate to your objectives, financial situation and needs. SIV does not guarantee the accuracy or timeliness of any information in this website, including information provided by third parties. We will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts, opinions and ideas contained within this website.

Except for personal non-commercial use, you may not copy, publish, distribute or reproduce any of the information contained in this newsletter in any form without the prior written consent of SIV. If you have any queries please email SIV at members@stocksinvalue.com.au. Our full terms & conditions are available on our public website (www.stocksinvalue.com.au/terms-conditions)

INVESTING REMINDER

Members, please note: investing in direct equity exposes you to the risk of capital loss. Before investing in any of these companies, we recommend you convince yourself, through your own research, that you agree with our theses or have an alternative positive thesis. It is also imperative that your portfolio weighting for any stock is consistent with your risk tolerance. Finally, we recommend you take a three to five-year view on all equity investments. These are not empty ‘caveats’, but the exact principles that our own fund manager partner makes, when investing on behalf of their clients – you should do similarly. Safe investing!

This note summarises the insights and understanding of StocksInValue at the time of publishing. Importantly, the understanding of our analysts will evolve in response to ongoing changes in company operating and financial performance, equity market conditions, internal research and discussions with management. As time passes after publication, reports become a less accurate reflection of the current thinking of StocksInValue analysts. While analysts endeavour to publish frequently about stocks of interest to members, they are not able to comment on all company, market and internal research developments. For this reason, members considering an investment based on our thesis are advised to always ensure they understand and still agree with that thesis, and are aware of the downside risks to their investment.

0 Comments